Time: 2023-11-16

Time: 2023-11-16  Views: 695

Views: 695

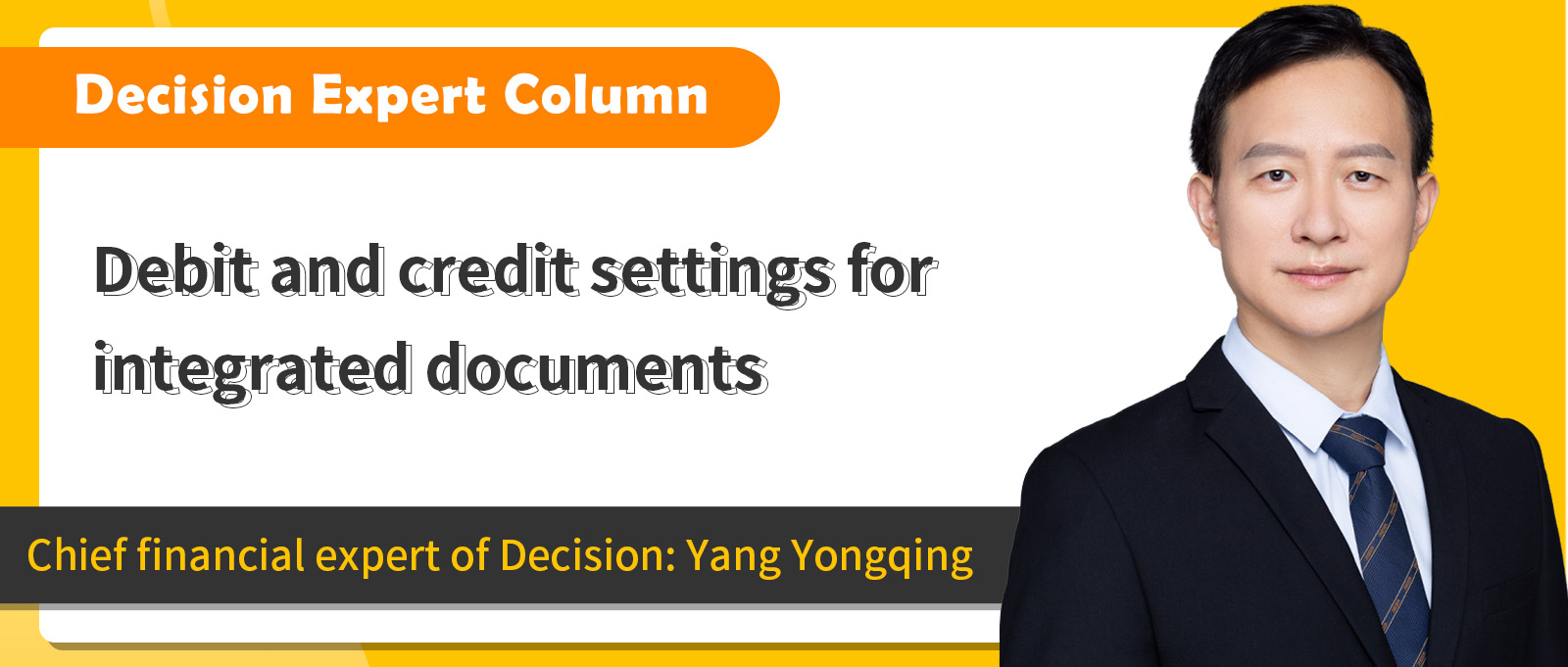

[Foreword]

The reason why Decision is highly praised by enterprises during the implementation of digital transformation projects is because experts are escorting Decision during the project process to help enterprises gain new knowledge, grow new capabilities, and improve management during the implementation of digital transformation projects. To improve our vision and reduce project misunderstandings, we have specially set up a "Decision Expert Column" to share with you a series of articles on the implementation of digital transformation projects, so stay tuned.

This article is based on Mr. Yang Yongqing, Decision’s chief financial expert, who has 24 years of rich experience in the field of SAP ERP, and combines the common misunderstandings he found in the implementation of ERP projects to publish corresponding research insights and suggestions to protect your SAP financial implementation and delivery.

[Problems and Needs]

How to realize asset transfer between companies within the group in the SAP system? Considering that the group as a whole issues consolidated statements, it is necessary to bring the depreciation conditions (life, capitalization date, depreciated years, remaining years), original value, accumulated depreciation, etc. of the original assets to the new company's new asset number in the system. How to achieve this processing?

[Asset transfer method]

(1) Assets are transferred between departments (processing: transaction code AS02, modify cost center);

(2) Transfer of assets within an asset company (processing: transaction code ABUMN, transfer asset A to asset B);

(3) Assets are transferred between different company codes under the same legal person (processing: transaction code ABT1N);

(4) Assets are transferred between different legal person company codes in the same group (processing: transaction code ABT1N)

The business processing of (3) and (4) above will be explained in detail in this article.

[Problem analysis]

1. How does the SAP system determine that the same legal person has different company codes?

In SAP system asset business, there are the following two judgments:

- Legally independent units

- Legally one unit

My personal understanding is: Legally independent units refers to legal entities that are independent of each other, such as a legal company; Legally one unit refers to a legal entity, which means that both parties to the transaction are within the same legal person.

Whether multiple company codes in the system are the same legal entity is determined by the system: company ID (Company).

Configure transaction code OX16, as shown in the figure above. Company codes 1000 and 6000 correspond to different companies respectively, so all business between the two companies belongs to: Legally independent units.

2. What is the gross method and what is the net method?

SAP inter-company asset transfers include gross method and net method:

The so-called gross method refers to transferring the original value and accumulated depreciation of the assets to the new company assets respectively;

The so-called net amount method refers to transferring the net asset value (=original value-accumulated depreciation) to the new company assets.

[System related configuration]

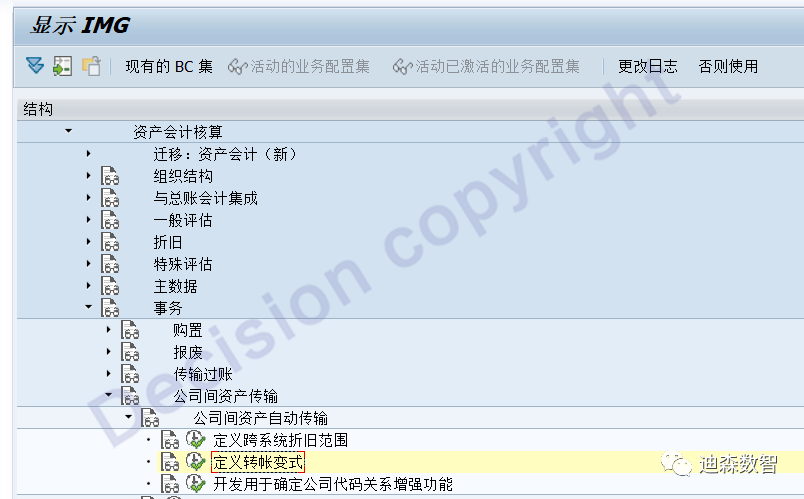

?

① Transfer variant, default asset transaction type (using SAP standard configuration).

【Service Guide】

For more information on SAP courses, project consultation and operation and maintenance, please call Decision's official consultation hotline: 400-600-8756

【About Decision】

Global professional consulting, technology and training service provider, SAP gold partner, SAP software partner, SAP implementation partner, SAP official authorized training center. Seventeen years of quality, trustworthy!